Introduction

AI has undoubtedly revolutionized the financial services industry and continues to make significant strides in various sectors. Its impact is evident in streamlining processes, improving customer experiences, and enabling data-driven decision-making.

Recently, a groundbreaking AI breakthrough has captured global attention, underscoring the ongoing momentum of the AI revolution. This rapid progress has led to AI becoming a top priority for investment, with analysts projecting the global AI market to exceed $521.3 billion by 2028, exhibiting an impressive compound annual growth rate (CAGR) of 35% from 2023 to 2028.

Although 2023 presents challenging global market conditions, the tech industry is remaining resilient. IT spending worldwide is forecasted to rise by 5.5% according to Gartner. Among economic uncertainties, experts are optimistic about AI’s prospects, as it has demonstrated its ability to weather downturns and help businesses become more efficient, doing more with less.

As the year progresses, AI impacted the financial services landscape and beyond, driving innovation and transformative change across industries. With its potential to address complex challenges and deliver valuable insights, AI remains a key driver of growth and progress in the tech world, cementing its position as an indispensable tool for businesses worldwide.

What is an AI-powered chatbot?

Chatbots are computer programs designed to simulate human-like conversations with users through natural language interfaces. They use artificial intelligence (AI) and natural language processing (NLP) technologies to understand user input, process it, and provide relevant responses. Chatbots can be integrated into various platforms such as websites, messaging apps, and social media platforms to facilitate interactions with users and provide them with information, answer queries, and assist with various tasks.

Chatbot development [AM1] is becoming increasingly popular in the fintech domain, as they offer a number of benefits for both businesses and customers.

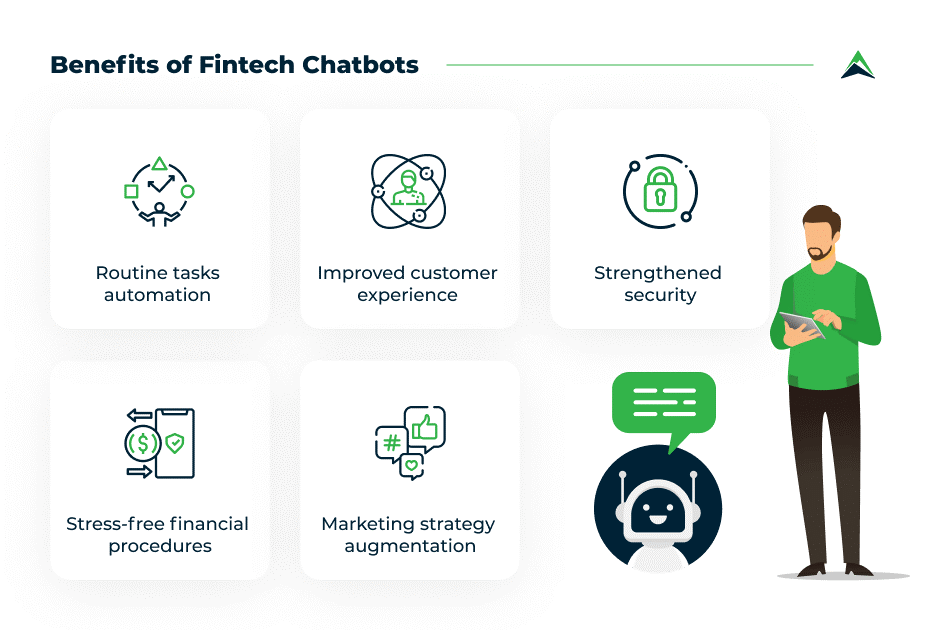

Benefits for Finance

Improved customer service: Chatbot development services can provide 24/7 customer service, which can be especially helpful for customers who have questions or problems outside of normal business hours. Chatbots can also answer common questions quickly and efficiently, which will free up customer service representatives to focus on more complex issues.

Reduced costs: By automating numerous tasks currently handled by customer service representatives, chatbots offer a cost-effective solution to reduce operational expenses. This can free up those representatives to focus on more complex issues, and it can also help to reduce the number of employees that are needed to provide customer service.

Increased customer satisfaction: Chatbots can help to increase customer satisfaction by providing a more convenient and efficient way to interact with financial institutions. Chatbots can collect customer feedback, which can help financial institutions to improve their products and services.

Benefits for customers

Convenience: Chatbots are available 24/7, so customers can get help with their financial questions or problems anytime.

Efficiency: Chatbots can answer questions quickly and efficiently, which can save customers time.

Personalization: Chatbots can be customized to the individual customer, providing a more tailored experience.

Security: It can be used to provide secure conversations, which can give customers peace of mind.

Latest stats and data

According to a recent report by Juniper Research, chatbots save the financial services industry $8 billion by 2023. The report also found that chatbots can increase customer satisfaction by up to 30%.

In 2022, the global chatbot market was valued at $1.2 billion. It is expected to reach $15.7 billion by 2028, growing at a CAGR of 22.3%.

The banking and financial services sector is the largest user of chatbots, accounting for 35% of the global market.

Chatbots are used for various tasks in the fintech domain, including customer service, account management, fraud detection, and marketing.

A study by Chatbots Magazine found that 73% of customers are satisfied with the chatbot experience.

In addition to the benefits listed above, chatbots can also be used to:

Provide personalized financial advice: Chatbots can collect information about a customer’s financial goals and risk tolerance, and provide personalized advice on achieving those goals.

Help customers manage their finances: They can be used to help customers track their spending, set budgets, and make payments.

Detect fraud: Chatbots can be used to analyze financial transactions for signs of fraud.

Market financial products and services: They can be used to reach out to potential customers and promote financial products and services.

Overall, chatbots offer a number of benefits for both businesses and customers in the fintech domain. As the use of chatbots continues to grow, we can expect to see even more benefits for the fintech industry.

Conclusion

Chatbots are a valuable tool for the fintech domain. They can help to improve customer service, reduce costs, and increase customer satisfaction. As the use of chatbots continues to grow, we can expect to see even more benefits for the fintech industry.

Looking for top-notch Chatbot development services? Look no further than Werq Labs!