Companies are leveraging the power of data to drive performance and gain smart insights into their business operations. Data Analysis involves statistical and mathematical models to extract meaningful information from raw data.

In this blog, we will explore how Data Analysis transforms Fintech and the various tools and techniques used to implement it. We will discuss key ways that data analysis is being used in fintech.

Ready to unravel the hidden potential of data? Let’s get started!

So, before going ahead get to know what exactly is data analysis

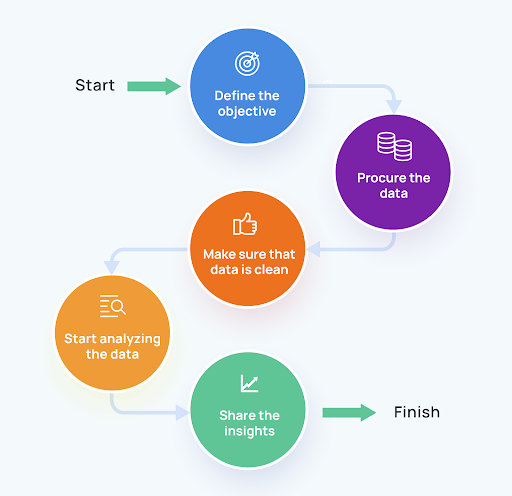

Data analysis is the process of inspecting, cleansing, transforming, and interpreting raw data to discover meaningful patterns, trends, and insights. It involves various statistical and computational techniques to extract valuable information from data sets, enabling businesses and organizations to make informed decisions, identify opportunities, and solve problems.

Data analysis plays a vital role in numerous industries, including finance, healthcare, marketing, and technology. By analyzing data, businesses can gain a deeper understanding of their customers, optimize their operations, improve products and services, and stay ahead of the competition. It is an essential tool for making data-driven decisions and driving innovation in today’s data-driven world.

There exist various approaches to data analysis, and the choice of method depends on your specific objectives and desired outcomes.

A/B testing involves comparing two test groups to assess their differences and performance.

Data fusion and integration enhance accuracy by analyzing and merging data from diverse sources.

Data mining is the process of identifying patterns within vast datasets and extracting them for analysis.

Machine learning employs computer algorithms to automatically develop analytical research models.

Natural language processing (NLP) utilizes computer algorithms to study and understand human languages.

How Data Analysis is Shaping Fintech

Fintech is a dynamic industry where innovation breeds competitive advantage. Companies are looking for new ways to gain an information edge through data analysis. This technology has made it possible to extract meaningful insights from huge volumes of data in near-real-time to drive decision-making processes. Data analysis has emerged as a game-changing tool that can help fintech companies to keep pace with changing consumer behaviors and preferences.

Applications of Data Analysis have been significant. Businesses can produce personalized marketing campaigns to target specific consumer segments, by leveraging customer data. Lenders use data analytics to determine creditworthiness while insurers model risks to better price policies. Another key benefit of data analysis in fintech is the emergence of robo-advisors that offer tailored investment solutions to customers through algorithmic intelligence.

Here are some of the key ways that data analysis is being used in fintech

Personalization: Data analysis can create more personalized financial services. For example, a fintech company could use data on customer spending habits to recommend products or services that are unique to their needs.

Fraud detection: Data analysis can identify fraudulent transactions. This is important for protecting customers and ensuring the security of financial systems.

Risk management: It can reduce the risk and make better lending decisions. This can help fintech companies reduce their exposure to bad debt and other losses.

Market research: It is also employed to identify new market opportunities and understand customer needs. This can help fintech companies develop new products and services that are in demand.

Data analysis is still in its early stages, but it is important to revolutionize the industry. As more data available, fintech companies can use data analysis to gain even deeper insights into customer behavior and improve their products and services.

Here are some specific examples of how data analysis is being used in fintech today

Credit scoring: Data analysis can develop more accurate credit scoring models. This can help lenders make better lending decisions and reduce their risk of default.

Investment management: It also develop more sophisticated investment strategies. This can help investors achieve their financial goals more effectively.

Fraud detection: Data analysis helps to identify fraudulent transactions in real-time. This can help financial institutions protect their customers and their systems from fraud.

As data analysis continues to grow, it is likely to have a profound impact on the industry. Fintech companies that can effectively use data analysis will be well-positioned to succeed in the upcoming years.

Summary

In conclusion, data analysis is the bedrock of fintech innovation. The transformative power of data-driven decision-making has reshaped the financial services landscape, providing personalized and customer-centric solutions. However, with these opportunities come significant responsibilities.

Fintech companies must prioritize data privacy, security, and ethical considerations to maintain customer trust and industry credibility. As the fintech industry growing continuously, data analysis will remain at its core, driving growth, efficiency, and customer satisfaction.